Background

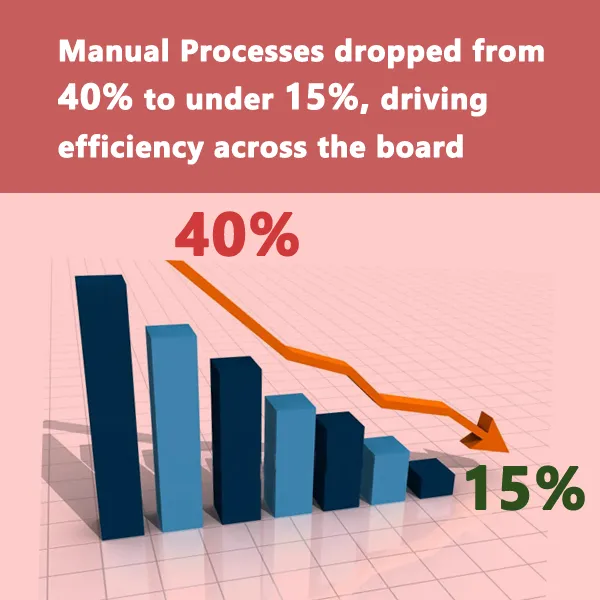

Three leading banks in the Sultanate of Oman had implemented Finastra’s Trade Innovation platform over a decade ago. Since then, only essential system and functional updates were undertaken. However, over 40% of trade processes remained manual. Financing modules were not configured with Finastra Trade Innovation. Also few life cycles of products & mid office functions for exception approvals were manual in nature. These led to income leakage, frequent exception approvals, and cumbersome treasury reporting.

To address these challenges and improve automation, the banks engaged TXN Alliance to conduct a comprehensive system health check and develop a roadmap for enhanced adoption of the Trade Innovation platform.

Transforming Transaction Banking for a Leading Islamic Bank in Oman: USD 1 Million in Capital Cost Savings and Strategic Growth

Transforming Transaction Banking for a Leading Islamic Bank in Oman: USD 1 Million in Capital Cost Savings and Strategic Growth Delivering Over USD 465K in Cost Savings and Revenue Growth for a Leading Omani Bank

Delivering Over USD 465K in Cost Savings and Revenue Growth for a Leading Omani Bank Modernizing Trade Finance in Oman: A Finastra Case Study

Modernizing Trade Finance in Oman: A Finastra Case Study Corporate Lending Health check for a leading Bank in Malaysia

Corporate Lending Health check for a leading Bank in Malaysia